Mastering the Markets with Mark Minervini’s Books

Mark Minervini is a renowned stock trader and author who has achieved remarkable success in the financial markets. His trading philosophy is centered around the concept of “Trade Like a Champion,” which emphasizes the importance of discipline, patience, and a systematic approach to trading. Minervini’s strategies are based on a combination of technical and fundamental analysis, allowing him to identify high-potential stocks and time his entries and exits with precision.

Unlike many other traders who rely solely on technical analysis or fundamental analysis, Minervini believes in using both approaches to gain a comprehensive understanding of the market. He combines technical indicators and chart patterns with a thorough analysis of a company’s financials and industry trends. This holistic approach enables him to identify winning stocks that have both strong technical setups and solid fundamentals.

Key Takeaways

- Mark Minervini’s trading strategies are based on a combination of technical and fundamental analysis.

- A winning mindset is crucial for successful trading, including discipline, patience, and the ability to manage emotions.

- Technical analysis techniques such as chart patterns and indicators can help identify winning stocks.

- Fundamental analysis, including financial statements and industry trends, can also play a role in stock picking.

- Trading psychology is important for overcoming common mistakes and emotions, such as fear and greed.

- Risk management is essential for minimizing losses and maximizing profits in trading.

- Developing a trading plan can help ensure consistent profits and avoid impulsive decisions.

- Mark Minervini’s methods can help traders achieve financial freedom by mastering the markets.

- Real-life case studies demonstrate the success of Mark Minervini’s trading strategies.

- By combining technical and fundamental analysis, risk management, and a winning mindset, traders can master the markets with Mark Minervini’s comprehensive approach.

The Importance of a Winning Mindset in Trading

Trading is not just about analyzing charts and numbers; it also requires a strong mindset. The psychological aspects of trading can have a significant impact on performance, and developing a winning mindset is crucial for success in the markets.

One of the key psychological barriers that traders often face is fear. Fear can lead to hesitation, causing traders to miss out on profitable opportunities or exit trades prematurely. Minervini emphasizes the importance of overcoming fear by having a well-defined trading plan and sticking to it. By having clear rules and guidelines in place, traders can reduce the influence of emotions on their decision-making process.

Another common mental barrier in trading is overconfidence. After experiencing a string of successful trades, traders may become overconfident and take on excessive risk or deviate from their trading plan. Minervini advises against this behavior and stresses the importance of staying disciplined and sticking to the proven strategies that have worked in the past.

Technical Analysis Techniques for Identifying Winning Stocks

Minervini’s trading strategies heavily rely on technical analysis to identify winning stocks. He uses a combination of chart patterns, trend analysis, and technical indicators to determine the optimal entry and exit points for his trades.

One of the key chart patterns that Minervini looks for is the cup and handle pattern. This pattern typically occurs after a stock has experienced a significant uptrend, followed by a consolidation period. The cup and handle pattern is characterized by a rounded bottom (the cup) followed by a smaller consolidation (the handle). Minervini considers this pattern to be a bullish signal and looks for stocks that exhibit this pattern as potential buying opportunities.

In addition to chart patterns, Minervini also uses technical indicators to confirm his trading decisions. One of the indicators he frequently uses is the Relative Strength Index (RSI), which measures the strength and momentum of a stock’s price movement. By combining chart patterns with technical indicators, Minervini is able to identify high-potential stocks that are likely to experience significant price movements.

Fundamental Analysis and its Role in Stock Picking

| Metrics | Description |

|---|---|

| Price-to-Earnings Ratio (P/E Ratio) | A valuation ratio that compares a company’s current share price to its per-share earnings. |

| Price-to-Book Ratio (P/B Ratio) | A valuation ratio that compares a company’s current share price to its book value per share. |

| Dividend Yield | A financial ratio that shows how much a company pays out in dividends each year relative to its share price. |

| Return on Equity (ROE) | A financial ratio that measures a company’s profitability by calculating how much profit it generates with the money shareholders have invested. |

| Debt-to-Equity Ratio | A financial ratio that compares a company’s total debt to its total equity. |

| Free Cash Flow (FCF) | A financial metric that shows how much cash a company generates after accounting for capital expenditures. |

While technical analysis plays a significant role in Minervini’s trading strategies, he also recognizes the importance of fundamental analysis in stock picking. Fundamental analysis involves evaluating a company’s financials, industry trends, and competitive position to determine its intrinsic value.

When evaluating a stock’s fundamentals, Minervini looks for companies with strong earnings growth, solid balance sheets, and competitive advantages. He believes that companies with consistent earnings growth are more likely to outperform the market over the long term. In addition, he pays close attention to industry trends and looks for companies that are positioned to benefit from favorable market conditions.

Minervini also considers valuation metrics when evaluating a stock’s fundamentals. While he acknowledges that valuation alone is not sufficient to determine whether a stock is a good investment, he believes that buying stocks at reasonable prices can provide a margin of safety and increase the probability of success.

Trading Psychology: Overcoming Common Mistakes and Emotions

Trading psychology plays a crucial role in a trader’s success or failure. Emotions such as fear, greed, and impatience can cloud judgment and lead to costly mistakes. Minervini emphasizes the importance of managing emotions and developing a disciplined mindset to overcome these common pitfalls.

One of the most common psychological mistakes that traders make is letting emotions dictate their trading decisions. Fear of missing out (FOMO) can lead to impulsive buying decisions, while fear of losing money can cause traders to exit trades prematurely. Minervini advises traders to stick to their trading plan and not let emotions drive their decision-making process.

Greed is another emotion that can be detrimental to a trader’s performance. When a trade is going well, traders may become greedy and hold on to a winning position for too long, hoping for even greater profits. This can result in missed opportunities and potential losses. Minervini recommends setting clear profit targets and sticking to them, rather than trying to squeeze every last penny out of a trade.

The Importance of Risk Management in Trading

Risk management is a critical aspect of Minervini’s trading approach. He believes that preserving capital is just as important as making profits, and he emphasizes the need for strict risk management rules.

One of the key risk management techniques that Minervini advocates is position sizing. Position sizing involves determining the appropriate amount of capital to allocate to each trade based on the risk-reward ratio. By limiting the size of each position, traders can minimize the impact of potential losses on their overall portfolio.

Another risk management technique that Minervini uses is the use of stop-loss orders. A stop-loss order is an order placed with a broker to sell a stock if it reaches a certain price level. By setting a stop-loss order at a predetermined level, traders can limit their potential losses and protect their capital.

Developing a Trading Plan for Consistent Profits

A well-defined trading plan is essential for consistent profits in the markets. Minervini emphasizes the importance of having a clear set of rules and guidelines that govern every aspect of the trading process.

A trading plan should include specific entry and exit criteria, risk management rules, and guidelines for evaluating potential trades. It should also outline the trader’s goals, timeframes, and risk tolerance. By having a trading plan in place, traders can eliminate guesswork and make informed decisions based on a systematic approach.

It is important to note that a trading plan is not set in stone and should be reviewed and adjusted as needed. Market conditions and individual circumstances can change over time, and a trading plan should be flexible enough to adapt to these changes.

Trading for a Living: Achieving Financial Freedom with Mark Minervini’s Methods

Trading has the potential to provide financial freedom, but it is important to have realistic expectations. While it is possible to make significant profits in the markets, it is also important to recognize that trading involves risks and losses are inevitable.

Minervini’s methods can certainly help traders achieve consistent profits, but it takes time, effort, and dedication to master his strategies. Traders should be prepared to invest in their education, practice their skills, and continuously improve their trading abilities.

It is also important to have a solid financial foundation before transitioning to full-time trading. Traders should have sufficient savings or alternative sources of income to support themselves during periods of drawdowns or market downturns.

Case Studies: Real-Life Examples of Mark Minervini’s Successful Trades

To illustrate the effectiveness of Minervini’s strategies, let’s take a look at some real-life examples of his successful trades.

One example is Minervini’s trade on Netflix (NFLX) in 2013. He identified a cup and handle pattern forming on the stock’s chart, indicating a potential bullish breakout. He entered the trade when the stock broke out of the handle and continued to rise. Minervini held the position until the stock reached his profit target, resulting in a significant gain.

Another example is Minervini’s trade on Facebook (FB) in 2016. He noticed that the stock was forming a bullish flag pattern, which is a continuation pattern that often leads to further upside. Minervini entered the trade when the stock broke out of the flag pattern and rode the uptrend until it reached his profit target.

These examples demonstrate how Minervini’s technical analysis techniques can be used to identify winning stocks and time entries and exits with precision.

Putting it All Together: Mastering the Markets with Mark Minervini’s Comprehensive Approach

In summary, Mark Minervini’s trading strategies are based on a comprehensive approach that combines technical and fundamental analysis. By using a combination of chart patterns, technical indicators, and fundamental analysis, he is able to identify high-potential stocks and time his trades with precision.

Developing a winning mindset is crucial for success in trading. Traders must overcome common psychological barriers such as fear and greed and develop discipline and patience. Risk management is also essential, as preserving capital is just as important as making profits.

By developing a well-defined trading plan and sticking to proven strategies, traders can achieve consistent profits in the markets. While trading has the potential to provide financial freedom, it requires time, effort, and dedication to master the necessary skills. By implementing Mark Minervini’s comprehensive approach to trading, traders can increase their chances of success in the markets.

FAQs

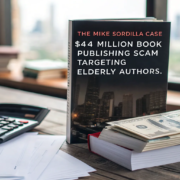

What are Mark Minervini books?

Mark Minervini books are a series of books written by Mark Minervini, a stock market investor and trader. These books cover various topics related to stock market investing and trading, including technical analysis, risk management, and trading psychology.

What is the content of Mark Minervini books?

The content of Mark Minervini books varies depending on the book. However, most of his books cover topics related to stock market investing and trading, including technical analysis, risk management, and trading psychology. Some of his books also include case studies and examples of successful trades.

How many Mark Minervini books are there?

As of 2021, Mark Minervini has written four books. These include “Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market,” “Think and Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard,” “Momentum Masters: A Roundtable Interview with Super Traders,” and “Mindset Secrets for Winning: How to Bring Personal Power to Everything You Do.”

Are Mark Minervini books suitable for beginners?

Mark Minervini books are not specifically designed for beginners. However, they can be useful for anyone interested in stock market investing and trading, regardless of their level of experience. Some of his books may be more advanced and technical, while others may be more accessible to beginners.

Where can I buy Mark Minervini books?

Mark Minervini books are available for purchase on various online retailers, including Amazon, Barnes & Noble, and Book Depository. They may also be available at local bookstores or libraries.