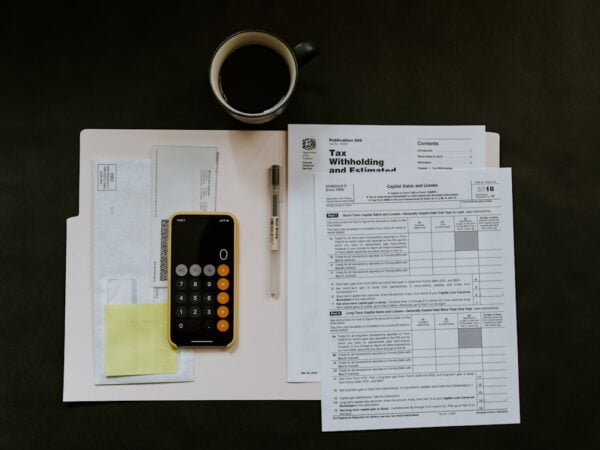

Understanding State Taxes: What You Need to Know for a Smooth Filing Experience

State taxes are taxes imposed by individual states on individuals and businesses within their jurisdiction. These taxes are used to fund various state programs and services, such as education, healthcare, infrastructure, and public safety. Paying state taxes is an important civic duty that helps support the functioning of state governments and ensures the well-being of the community.

The history of state taxes dates back to the early days of the United States. In fact, state taxes were one of the primary sources of revenue for the newly formed states after the American Revolution. Over time, the types and rates of state taxes have evolved to meet the changing needs of society. Today, state taxes play a crucial role in funding essential services and maintaining the overall economic health of each state.

Key Takeaways

- State taxes are taxes imposed by individual states on income, sales, property, and other transactions.

- Different types of state taxes include income tax, sales tax, property tax, and excise tax, each with a specific purpose.

- State tax filing requirements vary by state and depend on factors such as income level and residency status.

- Understanding state tax forms is important to ensure accurate and timely filing of your return.

- Common state tax deductions and credits can help maximize your refund, while payment options and planning can help minimize your tax liability.

Different Types of State Taxes and Their Purpose

There are several different types of state taxes, each with its own purpose and method of collection. The most common types of state taxes include income tax, sales tax, property tax, excise tax, estate tax, and gift tax.

Income tax is a tax on an individual’s or business’s income. It is typically calculated based on a percentage of the taxpayer’s taxable income. The purpose of income tax is to generate revenue for the state government and ensure that individuals and businesses contribute their fair share towards public services.

Sales tax is a tax imposed on the sale of goods and services. It is usually calculated as a percentage of the purchase price and collected by the seller at the point of sale. The purpose of sales tax is to generate revenue for the state government based on consumer spending.

Property tax is a tax on real estate property, including land and buildings. It is typically based on the assessed value of the property and collected by local governments. The purpose of property tax is to fund local services such as schools, roads, and public safety.

Excise tax is a tax on specific goods or activities, such as gasoline, tobacco, alcohol, and gambling. The purpose of excise tax is to discourage the consumption of certain goods or activities and generate revenue for the state government.

Estate tax is a tax on the transfer of property upon a person’s death. It is typically based on the value of the estate and collected by the state government. The purpose of estate tax is to generate revenue and prevent the concentration of wealth in a few individuals or families.

Gift tax is a tax on the transfer of property from one person to another without receiving anything in return. It is typically based on the value of the gift and collected by the state government. The purpose of gift tax is to prevent individuals from avoiding estate taxes by giving away their assets before they die.

State Tax Filing Requirements: Who Needs to File and When?

Not everyone is required to file state taxes. The filing requirements vary from state to state, but generally, individuals are required to file state taxes if they meet certain income thresholds or have other sources of income within the state.

In most states, individuals are required to file state taxes if their income exceeds a certain threshold, which is usually based on their filing status (single, married filing jointly, etc.). This threshold can vary significantly from state to state, so it’s important to check the specific requirements for your state.

In addition to income thresholds, individuals may also be required to file state taxes if they have other sources of income within the state. For example, if you earn income from rental properties or have a business that operates within the state, you may be required to file state taxes even if your total income falls below the threshold.

The deadline for filing state taxes also varies from state to state. Most states follow the federal tax deadline of April 15th, but some states have different deadlines. It’s important to check the specific deadline for your state and make sure to file your taxes on time to avoid penalties and interest.

Consequences of not filing state taxes can be severe. If you fail to file your state taxes, you may be subject to penalties and interest on the amount owed. In some cases, the state may also take legal action to collect the unpaid taxes, which can result in wage garnishment, bank levies, or liens on your property. It’s important to take your state tax obligations seriously and file your taxes on time to avoid these consequences.

Understanding State Tax Forms: How to Fill Out Your Return

| Topic | Description |

|---|---|

| State Tax Forms | Forms issued by state governments to collect taxes from individuals and businesses. |

| Types of Forms | Forms vary by state, but common types include income tax, sales tax, and property tax forms. |

| Filing Deadline | The date by which tax forms must be submitted to the state government. |

| Penalties | Fines or other consequences for failing to file tax forms or paying taxes owed. |

| Deductions | Expenses that can be subtracted from taxable income, reducing the amount of taxes owed. |

| Credits | Amounts that can be subtracted directly from taxes owed, reducing the overall tax bill. |

| State Tax Agencies | Government organizations responsible for collecting and enforcing state taxes. |

| Online Filing | The ability to submit tax forms electronically, often through state government websites. |

Filling out state tax forms can be a daunting task, but with a little preparation and understanding of the process, it can be relatively straightforward. State tax forms are typically similar to federal tax forms, but there may be some differences in terms of specific deductions, credits, and exemptions.

When filling out your state tax forms, it’s important to gather all the necessary documents and information beforehand. This includes your W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant financial documents. Having all the necessary information at hand will make the process much smoother and help ensure that you don’t miss any important deductions or credits.

Most state tax forms follow a similar format to federal tax forms, with sections for personal information, income, deductions, and credits. It’s important to read the instructions carefully and fill out each section accurately. Many states also provide online resources and calculators that can help you determine your tax liability and ensure that you’re claiming all the deductions and credits you’re eligible for.

Common mistakes to avoid when filling out state tax forms include failing to report all sources of income, miscalculating deductions or credits, and failing to sign and date the return. It’s important to double-check your return for accuracy before submitting it to avoid delays in processing or potential audits.

Common State Tax Deductions and Credits: Maximizing Your Refund

State tax deductions and credits can help reduce your tax liability and potentially increase your refund. While the specific deductions and credits available vary from state to state, there are some common ones that are available in most states.

Common deductions include state income tax paid, property tax paid, mortgage interest, medical expenses, and charitable contributions. These deductions can help reduce your taxable income and lower your overall tax liability.

Common credits include the child tax credit, earned income credit, education credits, and energy efficiency credits. These credits can directly reduce the amount of tax you owe or increase your refund.

To claim deductions and credits on your state tax return, you will typically need to provide supporting documentation, such as receipts or statements. It’s important to keep accurate records of your expenses throughout the year to ensure that you can claim all the deductions and credits you’re eligible for.

State Tax Payment Options: Choosing the Best Method for You

When it comes to paying state taxes, there are several options available. The most common methods include paying by check, electronic funds transfer (EFT), credit card, or online payment.

Paying by check is a traditional method that involves writing a check for the amount owed and mailing it to the appropriate state tax agency. This method is relatively simple but can be time-consuming and may result in delays if the check gets lost in the mail.

Electronic funds transfer (EFT) allows you to transfer funds directly from your bank account to the state tax agency. This method is convenient and secure but may require setting up an account with the state tax agency or using a third-party payment processor.

Paying by credit card allows you to charge the amount owed to your credit card and pay it off over time. This method is convenient but may incur additional fees or interest charges depending on your credit card terms.

Online payment is becoming increasingly popular as it allows you to pay your state taxes directly through the state tax agency’s website. This method is convenient, secure, and often offers instant confirmation of payment.

State Tax Audits: What to Expect and How to Prepare

A state tax audit is an examination of your state tax return to verify that you have reported your income and deductions accurately and paid the correct amount of tax. While the chances of being audited are relatively low, it’s important to be prepared in case it does happen.

There are several factors that can trigger a state tax audit, including discrepancies in reported income, unusually high deductions or credits, or random selection. If you are selected for an audit, you will typically receive a notice from the state tax agency outlining the specific issues they want to review.

During a state tax audit, you can expect to provide documentation and answer questions about your income, deductions, and credits. It’s important to be organized and have all the necessary documents readily available to support your claims.

To prepare for a state tax audit, it’s important to review your return for accuracy and ensure that you have documentation to support all your income, deductions, and credits. It’s also a good idea to familiarize yourself with the specific audit process for your state and seek professional help if needed.

State Tax Penalties and Consequences: Avoiding Costly Mistakes

Failing to comply with state tax laws can result in penalties and consequences that can be costly both financially and legally. Common mistakes that can result in penalties include failing to file or pay taxes on time, underreporting income, claiming false deductions or credits, and failing to maintain accurate records.

State tax penalties can vary depending on the specific violation and the state in which you reside. Common penalties include late filing penalties, late payment penalties, accuracy-related penalties, and fraud penalties. In addition to penalties, you may also be subject to interest charges on the amount owed.

To avoid costly mistakes when filing state taxes, it’s important to be organized, keep accurate records, and seek professional help if needed. It’s also important to stay informed about changes in state tax laws and regulations that may affect your tax liability.

State Tax Resources: Where to Find Help and Information

There are several resources available to help you navigate the complexities of state taxes and find answers to your questions. The most common resources include state tax websites, tax preparation software, and professional tax advisors.

State tax websites are a valuable source of information and provide access to forms, instructions, publications, and frequently asked questions. These websites also often provide online tools and calculators that can help you determine your tax liability and ensure that you’re claiming all the deductions and credits you’re eligible for.

Tax preparation software is another useful resource that can help simplify the process of filing state taxes. These software programs guide you through the process step by step, ask you relevant questions, and automatically calculate your tax liability based on the information you provide.

Professional tax advisors can provide personalized advice and guidance tailored to your specific situation. They can help you navigate complex tax laws, maximize your deductions and credits, and ensure that you’re in compliance with state tax regulations.

State Tax Planning: Tips for Minimizing Your Tax Liability

State tax planning involves taking proactive steps throughout the year to minimize your tax liability and maximize your refund. While the specific strategies will vary depending on your individual circumstances and the state in which you reside, there are some general tips that can help.

One of the most effective ways to minimize your state tax liability is to take advantage of all available deductions and credits. This includes keeping accurate records of your expenses, maximizing contributions to retirement accounts or health savings accounts, and taking advantage of education or energy efficiency credits.

Another strategy is to consider the timing of certain income or expenses. For example, if you expect to receive a large bonus or capital gain in a particular year, you may want to consider deferring it to the following year to reduce your taxable income. Similarly, if you have significant deductible expenses, such as medical expenses or charitable contributions, you may want to consider accelerating them into the current year to maximize your deductions.

It’s also important to stay informed about changes in state tax laws and regulations that may affect your tax liability. This includes keeping up to date with any new deductions or credits that may be available, as well as any changes in income thresholds or filing requirements.

In conclusion, state taxes are an important part of our civic duty and play a crucial role in funding essential services and maintaining the overall economic health of each state. Understanding the different types of state taxes, filing requirements, and payment options can help ensure that you fulfill your tax obligations and avoid penalties and consequences. By taking advantage of available deductions and credits, seeking professional help when needed, and engaging in proactive tax planning, you can minimize your tax liability and maximize your refund.

If you’re interested in learning more about state taxes, you might also find this article on the impact of sodium and ways to reduce salt intake fascinating. It delves into the importance of maintaining a healthy diet and provides valuable insights on how to lower your sodium intake. Check it out here!

FAQs

What are state taxes?

State taxes are taxes imposed by state governments on individuals and businesses within their jurisdiction. These taxes are separate from federal taxes and are used to fund state programs and services.

What types of state taxes are there?

There are several types of state taxes, including income taxes, sales taxes, property taxes, and excise taxes. The specific types of taxes and their rates vary by state.

How are state taxes collected?

State taxes are typically collected by state revenue departments or agencies. Individuals and businesses are required to file tax returns and pay taxes owed to the state.

What are state tax rates?

State tax rates vary by state and by type of tax. For example, some states have no income tax, while others have rates as high as 13.3%. Sales tax rates also vary by state, ranging from 2.9% to 7.5%.

What are state taxes used for?

State taxes are used to fund a variety of programs and services, including education, healthcare, transportation, public safety, and social services. The specific allocation of funds varies by state.

Can state taxes be deducted on federal tax returns?

Yes, state taxes can be deducted on federal tax returns. Taxpayers can choose to deduct either state income taxes or state sales taxes, but not both. The deduction is subject to certain limitations and restrictions.