Understanding Property Taxes: What You Need to Know

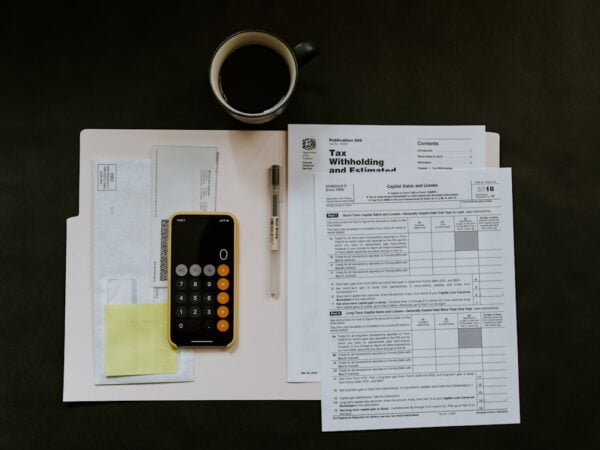

Property taxes are a form of taxation imposed on real estate by local governments. They are a crucial source of revenue for funding local government services such as schools, police and fire departments, road maintenance, and other essential services. Property taxes are levied based on the assessed value of the property, which is determined by local assessors. Understanding how property taxes work and how they are calculated is important for homeowners and real estate investors alike.

Key Takeaways

- Property taxes are a form of taxation on real estate that fund local government services.

- Property taxes are calculated based on the assessed value of the property and the tax rate set by the local government.

- Property assessments play a crucial role in determining the value of a property and, therefore, the amount of taxes owed.

- There are different types of property taxes, including ad valorem, special assessments, and transfer taxes.

- Property tax exemptions and deductions can help reduce the amount of taxes owed, but they vary by state and locality.

How Property Taxes are Calculated: Understanding the Process

Property tax rates are determined by a combination of factors, including the budgetary needs of the local government, the assessed value of the property, and the tax rate set by the local taxing authority. The assessed value of a property is determined by local assessors who evaluate the market value of the property and apply an assessment ratio to determine its taxable value. The tax rate is then applied to the taxable value to calculate the property tax bill.

For example, let’s say a property has an assessed value of $200,000 and the local tax rate is 1%. The taxable value would be $200,000 multiplied by the assessment ratio (which is typically less than 100%) to determine the taxable value. If the assessment ratio is 90%, then the taxable value would be $180,000. The tax bill would be $180,000 multiplied by 1%, resulting in a property tax bill of $1,800.

The Role of Property Assessments in Determining Taxes

Property assessments play a crucial role in determining property taxes. Assessments are conducted by local assessors who evaluate the market value of properties within their jurisdiction. They take into account factors such as location, size, condition, and recent sales prices of comparable properties to determine the assessed value.

The assessed value is then used to calculate the taxable value of the property, which is subject to property taxes. If the assessed value of a property increases, the property tax bill will also increase, assuming the tax rate remains the same. Conversely, if the assessed value decreases, the property tax bill will decrease as well.

Different Types of Property Taxes: Exploring the Options

| Type of Property Tax | Description | Advantages | Disadvantages |

|---|---|---|---|

| Ad Valorem Tax | A tax based on the assessed value of a property | Easy to administer, provides stable revenue for local governments | May not reflect current market value, can be regressive for low-income homeowners |

| Land Value Tax | A tax based on the value of the land only, not the buildings on it | Encourages development and discourages land speculation, can be progressive for low-income homeowners | May not provide enough revenue for local governments, can be difficult to assess land value accurately |

| Transfer Tax | A tax on the sale or transfer of a property | Can generate significant revenue for local governments, can be progressive for high-value properties | May discourage property sales, can be regressive for low-income homeowners |

| Special Assessment | A tax levied on a specific group of property owners for a specific purpose, such as road improvements | Can provide funding for specific projects, ensures that those who benefit from the project pay for it | May be difficult to determine who should pay the assessment, may be unpopular with property owners who do not benefit from the project |

There are different types of property taxes at both the state and local levels. Some states have a flat rate for property taxes, while others have a progressive tax system where higher-valued properties are subject to higher tax rates. Additionally, some local governments may impose additional taxes or fees on top of the state property tax.

For example, in California, property taxes are based on the assessed value of the property and are limited to 1% of that value. However, local governments can also impose additional taxes and fees, such as school district taxes or special assessments for infrastructure improvements.

Comparing property tax rates across different states can be helpful for homeowners and real estate investors who are considering purchasing property in different locations. It is important to take into account not only the tax rate but also other factors such as the overall cost of living and quality of local government services.

Understanding Property Tax Exemptions and Deductions

Property tax exemptions and deductions can help homeowners reduce their property tax bills. Exemptions are typically granted to certain groups of people, such as veterans, senior citizens, or disabled individuals. These exemptions can provide significant savings on property taxes.

Deductions, on the other hand, are available to all homeowners and can be claimed for certain expenses related to the property. For example, homeowners may be able to deduct mortgage interest or property taxes paid from their federal income taxes.

To apply for exemptions and deductions, homeowners typically need to submit an application to their local assessor’s office. It is important to check with your local government to determine what exemptions and deductions are available and how to apply for them.

The Impact of Property Taxes on Real Estate Investments

Property taxes can have a significant impact on real estate investments. High property tax rates can eat into rental income and reduce the profitability of an investment property. Additionally, property taxes can affect the value of a property, as potential buyers will take into account the ongoing tax burden when considering a purchase.

For example, if a property has high property taxes compared to similar properties in the area, it may be less attractive to potential buyers and may take longer to sell. On the other hand, properties with lower property taxes may be more desirable and command higher prices.

Real estate investors can employ strategies to manage property tax costs and mitigate their impact on investments. For example, investing in properties in areas with lower property tax rates or appealing property tax assessments can help reduce the overall tax burden. It is important for real estate investors to carefully consider property taxes when evaluating potential investment opportunities.

How Property Taxes Fund Local Government Services

Property taxes play a crucial role in funding local government services. They provide a stable source of revenue that is used to fund essential services such as schools, police and fire departments, road maintenance, parks and recreation facilities, and other infrastructure projects.

Local governments rely on property taxes to maintain and improve local infrastructure, provide public safety services, and support education. Without property taxes, these services would be severely impacted, leading to a decline in the quality of life for residents.

It is important for homeowners and taxpayers to understand that their property tax dollars are directly contributing to the services they rely on every day. By paying their fair share of property taxes, they are helping to support their local community and ensure that essential services are adequately funded.

The Importance of Staying Up-to-Date on Property Tax Changes

Property tax laws and regulations can change over time, so it is important for homeowners and real estate investors to stay informed about any changes that may affect their property tax bills. Changes in property tax rates, exemptions, or assessment practices can have a significant impact on property taxes.

Staying up-to-date on property tax changes can help homeowners and real estate investors plan and budget accordingly. It can also help them take advantage of any new exemptions or deductions that may be available to them.

There are several resources available for staying informed about property tax changes. Local government websites, assessor’s offices, and tax professionals can provide valuable information and guidance on property tax matters.

Common Property Tax Myths and Misconceptions

There are several common myths and misconceptions about property taxes that can lead to misunderstandings and confusion. One common myth is that property taxes are solely based on the market value of the property. While market value is a factor in determining assessed value, it is not the sole determinant.

Another common misconception is that property taxes only benefit homeowners. In reality, property taxes fund essential services that benefit the entire community, including renters and businesses.

It is important for homeowners and taxpayers to understand the facts about property taxes and dispel any myths or misconceptions they may have. By understanding how property taxes work and their role in funding local government services, homeowners can make informed decisions about their property tax obligations.

Tips for Managing and Reducing Your Property Tax Burden

There are several strategies homeowners can employ to manage and reduce their property tax burden. One strategy is to appeal the assessed value of the property if it is believed to be too high. This can be done by providing evidence of comparable properties with lower assessed values or demonstrating that the condition of the property has deteriorated.

Another strategy is to take advantage of any available exemptions or deductions. Homeowners should research what exemptions and deductions are available in their area and ensure they are taking full advantage of them.

Working with a tax professional who specializes in property taxes can also be beneficial. They can provide guidance on managing property tax costs and help homeowners navigate the complex world of property taxes.

In conclusion, property taxes are a crucial source of revenue for funding local government services. Understanding how property taxes work, how they are calculated, and how they can be managed is important for homeowners and real estate investors. By staying informed about property tax changes, understanding the role of property assessments, and taking advantage of available exemptions and deductions, homeowners can effectively manage their property tax burden.

If you’re interested in learning more about property taxes and how they can impact your financial well-being, you may also find our article on “The Impact of Processed Foods on Health and Ways to Choose Whole Foods” insightful. In this article, we explore the effects of processed foods on our health and provide tips on how to make healthier choices by opting for whole foods. Understanding the relationship between property taxes and our overall well-being is crucial, just like making informed decisions about the food we consume. Check out the article here.

FAQs

What are property taxes?

Property taxes are taxes that are levied on real estate by the government. These taxes are based on the value of the property and are used to fund local government services such as schools, roads, and public safety.

How are property taxes calculated?

Property taxes are calculated based on the assessed value of the property and the tax rate set by the local government. The assessed value is determined by a government assessor who evaluates the property’s market value, location, and condition.

Who pays property taxes?

Property taxes are paid by the owner of the property. This can be an individual, a corporation, or a government entity.

What happens if property taxes are not paid?

If property taxes are not paid, the government can place a lien on the property, which means that the property cannot be sold until the taxes are paid. In extreme cases, the government can also seize the property and sell it to pay off the unpaid taxes.

Can property taxes be appealed?

Yes, property owners can appeal their property tax assessment if they believe it is too high. This process varies by state and local government, but typically involves filing an appeal with the local tax assessor’s office and providing evidence to support the appeal.

Are property taxes deductible on income taxes?

Yes, property taxes are deductible on federal income taxes. However, there are limits to the amount that can be deducted, and the deduction is subject to change based on tax laws.