Maximizing Your Refund: A Guide to Successful Income Tax Filing

Understanding income tax filing is crucial for individuals and businesses alike. Filing taxes accurately and efficiently can help you avoid penalties, maximize your refund, and ensure financial success. In this article, we will provide a comprehensive guide to income tax filing, covering everything from the basics of income tax to strategies for reducing your tax liability. By the end of this article, you will have a thorough understanding of how to navigate the complexities of income tax filing and make the most of your financial situation.

Key Takeaways

- Income tax filing is a necessary process that requires understanding of basic concepts and terms.

- Organizing financial documents is crucial for a smooth tax season and avoiding errors or omissions.

- Identifying deductions and credits can help maximize your refund and reduce your tax liability.

- Self-employed individuals should keep accurate records and consider hiring a tax professional for guidance.

- Common tax filing mistakes can be avoided by double-checking information and seeking assistance when needed.

Understanding the basics of income tax filing

Income tax is a tax imposed on individuals or entities based on their income or profits. It is a primary source of revenue for governments and is used to fund public services and infrastructure. There are different types of income tax, including federal income tax, state income tax, and local income tax. Each type may have different rates and brackets.

Tax brackets and rates determine how much tax you owe based on your income level. The tax brackets are divided into ranges of income, and each range has a corresponding tax rate. As your income increases, you move into higher tax brackets with higher rates. It is important to understand the tax brackets and rates applicable to your situation in order to accurately calculate your tax liability.

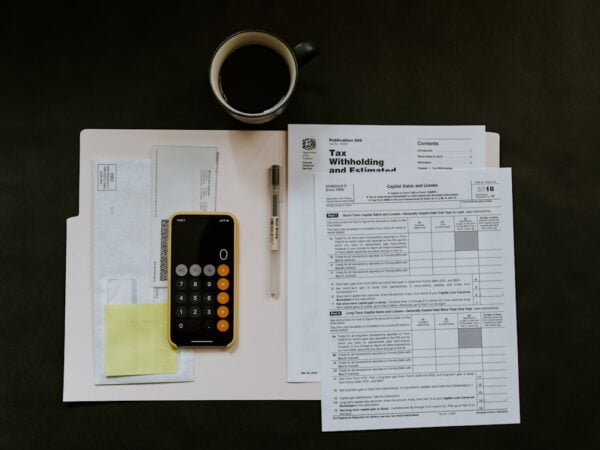

Organizing your financial documents for tax season

Organizing your financial documents is essential for a smooth and efficient tax filing process. By keeping your documents organized, you can easily access the information you need and ensure that you don’t miss any deductions or credits that you are eligible for.

Some important documents needed for tax filing include W-2 forms (for employees), 1099 forms (for self-employed individuals), bank statements, investment statements, receipts for deductible expenses, and records of charitable contributions. It is important to keep these documents organized throughout the year so that you can easily locate them when it’s time to file your taxes.

Tips for organizing financial documents include creating a filing system, using digital tools to store and organize documents, and keeping track of expenses and income throughout the year. By staying organized, you can save time and reduce stress during tax season.

Identifying deductions and credits to maximize your refund

| Category | Metric |

|---|---|

| Income | Total income earned |

| Amount of taxes withheld | |

| Deductions | Total amount of deductions |

| Charitable contributions | |

| Medical expenses | |

| Credits | Total amount of credits |

| Earned Income Tax Credit (EITC) | |

| Child Tax Credit | |

| Education credits |

Deductions and credits are two ways to reduce your tax liability and potentially increase your refund. Deductions are expenses that you can subtract from your taxable income, while credits are dollar-for-dollar reductions in the amount of tax you owe.

Common deductions include mortgage interest, student loan interest, medical expenses, and charitable contributions. By identifying and claiming these deductions, you can lower your taxable income and potentially reduce the amount of tax you owe.

Common credits include the Child Tax Credit, the Earned Income Tax Credit, and the American Opportunity Credit. These credits can provide significant savings on your tax bill. It is important to research and understand the eligibility requirements for each credit in order to claim them correctly.

To claim deductions and credits, you will need to fill out the appropriate forms or schedules when filing your taxes. It is important to keep accurate records of your expenses and income throughout the year to support your claims.

Tips for filing taxes as a self-employed individual

Self-employed individuals have unique tax considerations compared to employees. One of the key differences is the self-employment tax, which is a combination of Social Security and Medicare taxes that self-employed individuals are responsible for paying.

In addition to the self-employment tax, self-employed individuals may also be eligible for deductions specific to their business. These deductions can include expenses such as office supplies, advertising costs, and business travel expenses. It is important to keep detailed records of these expenses in order to claim them accurately.

Record-keeping is especially important for self-employed individuals. It is recommended to keep separate bank accounts for business and personal expenses, maintain detailed records of income and expenses, and keep copies of invoices and receipts. By staying organized and keeping accurate records, self-employed individuals can ensure that they are claiming all eligible deductions and credits and accurately reporting their income.

How to avoid common tax filing mistakes

Filing taxes can be complex, and it is easy to make mistakes. However, making mistakes on your tax return can have serious consequences, including penalties and interest charges. It is important to take the time to review your tax return carefully and avoid common mistakes.

Some common tax filing mistakes include errors in math calculations, entering incorrect Social Security numbers or other personal information, forgetting to sign the tax return, and failing to report all income. These mistakes can lead to delays in processing your return or even trigger an audit.

To avoid these mistakes, it is important to double-check all calculations, review your personal information for accuracy, and carefully report all income. It can also be helpful to use tax software or consult with a tax professional to ensure that your return is accurate and complete.

The benefits of e-filing your income tax return

E-filing, or electronic filing, is the process of submitting your tax return electronically instead of mailing a paper return. E-filing offers several benefits over traditional paper filing.

One of the main benefits of e-filing is speed. E-filing allows for faster processing of your tax return compared to paper filing. In most cases, you will receive your refund faster if you choose to e-file.

E-filing also reduces the risk of errors. When you e-file, the software automatically checks for errors or missing information before you submit your return. This can help you catch any mistakes before they are submitted to the IRS.

Additionally, e-filing offers convenience. You can e-file from the comfort of your own home and at any time that is convenient for you. You also have the option to receive your refund via direct deposit, which is faster and more secure than receiving a paper check.

To e-file your tax return, you will need to use tax software or work with a tax professional who offers e-filing services. The software or tax professional will guide you through the process and ensure that your return is submitted correctly.

Navigating tax laws and regulations for small business owners

Small business owners face unique challenges when it comes to income tax filing. There are specific tax laws and regulations that apply to small businesses, and it is important to understand and comply with these requirements.

Some key tax laws and regulations for small businesses include the classification of workers as employees or independent contractors, the reporting of income and expenses, and the payment of payroll taxes. Small business owners may also be eligible for certain deductions and credits that can help reduce their tax liability.

To comply with tax laws and regulations, small business owners should keep accurate records of income and expenses, file the appropriate forms and schedules, and pay any required taxes on time. It can be helpful to work with a tax professional who specializes in small business taxes to ensure that you are meeting all of your obligations.

Non-compliance with tax laws and regulations can result in penalties, fines, or even legal action. It is important to take the time to understand your obligations as a small business owner and seek professional advice if needed.

Strategies for reducing your tax liability

Reducing your tax liability can help you keep more of your hard-earned money. There are several strategies that individuals and businesses can use to minimize their tax burden.

One strategy is tax planning. By carefully planning your financial activities throughout the year, you can take advantage of deductions, credits, and other tax-saving opportunities. This may include timing the sale of investments or assets, maximizing contributions to retirement accounts, or making charitable donations.

Another strategy is investing in tax-saving investments. Certain investments, such as municipal bonds or retirement accounts, offer tax advantages that can help reduce your tax liability. It is important to research and understand the tax implications of different investments before making any decisions.

Additionally, taking advantage of tax credits and deductions can significantly reduce your tax liability. Some common credits and deductions include the Child Tax Credit, the Lifetime Learning Credit, and the mortgage interest deduction. It is important to review the eligibility requirements for each credit and deduction and consult with a tax professional if needed.

Planning for next year’s taxes: what to do now to save money later

While it may seem early to start thinking about next year’s taxes, taking proactive steps now can help you save money in the long run. By planning ahead and making strategic financial decisions, you can minimize your tax liability and potentially increase your refund.

One key aspect of planning for next year’s taxes is estimating your tax liability. By projecting your income and expenses for the upcoming year, you can get an idea of how much you will owe in taxes. This can help you make informed decisions about saving, investing, or making deductible expenses.

Adjusting your tax withholding is another important step in planning for next year’s taxes. If you received a large refund this year, it may be a sign that you are having too much tax withheld from your paycheck. By adjusting your withholding, you can increase your take-home pay throughout the year and potentially reduce your refund or even owe less in taxes.

It is also important to stay informed about changes to tax laws and regulations that may affect you. Tax laws are subject to change, and staying up-to-date on any new developments can help you make informed decisions about your finances.

Working with a tax professional: when to hire a CPA or tax attorney

While many individuals and businesses are able to successfully file their own taxes, there are situations where it may be beneficial to work with a tax professional. A certified public accountant (CPA) or tax attorney can provide expert advice and guidance, ensuring that you are taking advantage of all available deductions and credits and complying with tax laws and regulations.

There are several benefits to working with a tax professional. They have a deep understanding of tax laws and regulations and can help you navigate complex tax situations. They can also provide valuable advice on tax planning strategies and help you make informed decisions about your finances.

It may be beneficial to work with a tax professional if you have a complex financial situation, such as owning a business, investing in real estate, or receiving income from multiple sources. A tax professional can help you navigate the complexities of these situations and ensure that you are meeting all of your tax obligations.

When hiring a tax professional, it is important to do your research and find a reputable and experienced individual or firm. You can ask for recommendations from friends or colleagues, check online reviews, or consult with professional organizations such as the American Institute of Certified Public Accountants (AICPA) or the National Association of Tax Professionals (NATP).

Understanding income tax filing is essential for financial success. By understanding the basics of income tax, organizing your financial documents, identifying deductions and credits, avoiding common mistakes, e-filing your tax return, navigating tax laws and regulations, reducing your tax liability, planning for next year’s taxes, and working with a tax professional when needed, you can ensure that you are maximizing your refund and minimizing your tax liability. By taking the time to educate yourself and stay informed about changes to tax laws and regulations, you can make informed decisions about your finances and achieve financial success.

If you’re feeling overwhelmed by the upcoming income tax filing season, you might also be interested in learning about the impact of stress on your health. In a recent article on Wave Magnets, “Stress and Your Health: Understanding the Physical Effects and Proven Techniques for Coping,” you can discover how stress can affect your body and mind, and explore effective strategies to manage and reduce stress levels. Understanding the connection between stress and your overall well-being can help you navigate tax season with a healthier mindset. Check out the article here.

FAQs

What is income tax filing?

Income tax filing is the process of submitting your income tax return to the government. It involves reporting your income, deductions, and credits to determine how much tax you owe or how much of a refund you are entitled to.

Who needs to file income tax?

Anyone who earns income above a certain threshold is required to file income tax. The threshold varies depending on your filing status, age, and income level. Generally, if you are a U.S. citizen or resident alien, you must file a tax return if your gross income is at least $12,400 for single filers, $18,650 for head of household filers, or $24,800 for married filing jointly.

When is the deadline for income tax filing?

The deadline for income tax filing is typically April 15th of each year. However, the deadline may be extended to a later date if April 15th falls on a weekend or holiday. In 2021, the deadline was extended to May 17th due to the COVID-19 pandemic.

What happens if I miss the income tax filing deadline?

If you miss the income tax filing deadline, you may be subject to penalties and interest on any taxes owed. The penalty for filing late is usually 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%. If you are due a refund, there is no penalty for filing late.

What documents do I need to file income tax?

To file income tax, you will need to gather all of your income statements, such as W-2s and 1099s, as well as any deductions or credits you plan to claim. You may also need to provide documentation for certain expenses, such as charitable donations or business expenses.

Can I file income tax online?

Yes, you can file income tax online using tax preparation software or through the IRS website. Filing online is generally faster and more convenient than filing by mail, and you may also be able to receive your refund more quickly.