Mastering Stock Trading: Essential Books for Success

Stock trading is the buying and selling of shares or stocks of publicly traded companies on a stock exchange. It is a form of investment where individuals or institutions can participate in the ownership of a company and potentially profit from its success. The concept of stock trading dates back centuries, with the first stock exchange established in Amsterdam in the 17th century.

Stock trading plays a crucial role in the economy as it provides companies with access to capital for growth and expansion. It also allows individuals to invest their savings and potentially earn a return on their investment. The stock market serves as a barometer of economic health, reflecting the overall performance and sentiment of businesses and industries.

Key Takeaways

- Stock trading requires education and knowledge to be successful

- Essential books for mastering stock trading include “The Intelligent Investor” and “Technical Analysis of the Financial Markets”

- Technical analysis involves understanding charts and patterns to make informed trading decisions

- Fundamental analysis involves evaluating companies and industries to determine their potential for growth

- Successful trading requires a solid trading plan, risk management strategies, and emotional discipline.

The Importance of Education in Stock Trading

Education is crucial in stock trading as it provides individuals with the knowledge and skills needed to make informed investment decisions. Without proper education, investors may be susceptible to making costly mistakes and falling victim to scams or fraudulent activities.

One of the key benefits of education in stock trading is that it helps individuals understand the fundamental concepts and principles of investing. This includes learning about financial statements, valuation techniques, risk management strategies, and market analysis. By having a solid foundation in these areas, investors can make more informed decisions and minimize their risks.

There are various types of education available for those interested in stock trading. This includes formal education such as university courses or degrees in finance or economics. There are also online courses, seminars, workshops, and books that provide practical knowledge and insights into the world of stock trading.

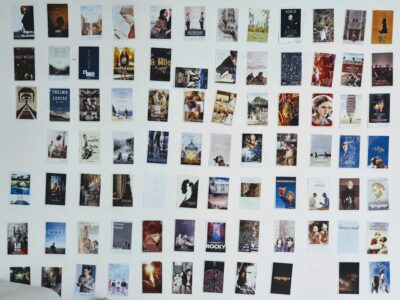

Essential Books for Mastering Stock Trading

Books are an invaluable resource for anyone looking to master the art of stock trading. They provide in-depth knowledge, practical tips, and real-life examples that can help investors navigate the complexities of the stock market.

For beginners, some essential books include “A Random Walk Down Wall Street” by Burton Malkiel, which provides an overview of investing strategies and the importance of diversification. “The Intelligent Investor” by Benjamin Graham is another must-read, as it covers the principles of value investing and the importance of analyzing a company’s fundamentals.

For more advanced traders, books like “Technical Analysis of the Financial Markets” by John J. Murphy provide a comprehensive guide to understanding charts, patterns, and indicators. “Reminiscences of a Stock Operator” by Edwin Lefèvre is a classic that offers insights into the mindset and psychology of successful traders.

Reading books is important in stock trading as it allows investors to learn from the experiences and wisdom of successful traders. It also helps individuals develop a deeper understanding of the market and its various dynamics.

Technical Analysis: Understanding Charts and Patterns

| Technical Analysis: Understanding Charts and Patterns | Metrics |

|---|---|

| Price | The current price of the asset being analyzed. |

| Volume | The number of shares or contracts traded during a specific time period. |

| Trend | The direction of the market or asset price movement over time. |

| Support and Resistance | Price levels where buying or selling pressure is expected to be strong enough to prevent the price from moving beyond a certain point. |

| Chart Patterns | Recurring patterns that can be identified on a price chart and used to predict future price movements. |

| Indicators | Mathematical calculations based on price and/or volume data that can be used to confirm or predict price movements. |

| Candlestick Charts | A type of chart used to represent price movements that displays the open, high, low, and close for each time period as a candlestick. |

Technical analysis is a method used by traders to forecast future price movements based on historical price data. It involves analyzing charts, patterns, and indicators to identify trends and make informed trading decisions.

There are several types of charts used in technical analysis, including line charts, bar charts, and candlestick charts. Line charts provide a simple representation of price movements over time, while bar charts show the opening, closing, high, and low prices for a given period. Candlestick charts are similar to bar charts but provide additional information about market sentiment through the use of different candlestick patterns.

Patterns are another important aspect of technical analysis. These include support and resistance levels, trendlines, and chart patterns such as head and shoulders, double tops, and triangles. By identifying these patterns, traders can anticipate potential price movements and make profitable trades.

Technical analysis is a valuable tool in stock trading as it helps investors identify entry and exit points for their trades. It can also provide insights into market sentiment and help traders manage their risks effectively.

Fundamental Analysis: Evaluating Companies and Industries

Fundamental analysis is a method used to evaluate the intrinsic value of a company or industry by analyzing its financial statements, management team, competitive position, and industry trends. It involves assessing the company’s assets, liabilities, revenues, expenses, and cash flows to determine its true worth.

Fundamental analysis is important in stock trading as it helps investors make informed decisions based on the underlying value of a company. By understanding the financial health and prospects of a company, investors can determine whether it is undervalued or overvalued and make appropriate investment decisions.

To conduct fundamental analysis, investors need to analyze a company’s financial statements, including its balance sheet, income statement, and cash flow statement. They also need to assess the company’s competitive position, industry trends, and management team. By combining these factors, investors can gain a holistic view of the company’s prospects and make more accurate investment decisions.

Trading Strategies: From Day Trading to Long-Term Investing

There are various trading strategies that investors can employ in stock trading, depending on their goals, risk tolerance, and time horizon. These strategies range from day trading, where traders buy and sell stocks within a single day, to long-term investing, where investors hold stocks for several years.

Day trading is a high-risk strategy that requires constant monitoring of the market and quick decision-making. It involves taking advantage of short-term price fluctuations to make profits. Swing trading is another short-term strategy that aims to capture price movements over a few days or weeks.

On the other hand, long-term investing involves buying stocks with the intention of holding them for several years or even decades. This strategy is based on the belief that over time, the stock market tends to rise and generate positive returns. It requires patience and discipline to ride out market fluctuations and stay focused on long-term goals.

Choosing the right trading strategy depends on various factors such as risk tolerance, time commitment, and investment goals. It is important for investors to understand their own preferences and capabilities before deciding on a strategy.

Risk Management: Protecting Your Capital and Maximizing Returns

Risk management is a crucial aspect of stock trading as it helps investors protect their capital and maximize their returns. It involves identifying and assessing potential risks, implementing strategies to mitigate those risks, and monitoring the portfolio to ensure that risk levels are within acceptable limits.

One of the key principles of risk management is diversification. This involves spreading investments across different asset classes, sectors, and geographies to reduce the impact of any single investment on the overall portfolio. By diversifying, investors can minimize the risk of losing all their capital if one investment performs poorly.

Another important aspect of risk management is setting stop-loss orders. These are predetermined price levels at which investors will sell their stocks to limit potential losses. Stop-loss orders help investors protect their capital and prevent emotional decision-making during periods of market volatility.

Risk management also involves regularly monitoring and reviewing the portfolio to ensure that it remains aligned with the investor’s goals and risk tolerance. This may involve rebalancing the portfolio by buying or selling stocks to maintain the desired asset allocation.

Psychology of Trading: Controlling Emotions and Staying Disciplined

The psychology of trading plays a crucial role in stock trading as it can greatly influence an investor’s decision-making process. Emotions such as fear, greed, and overconfidence can lead to irrational decisions and poor investment outcomes.

Fear is a common emotion in stock trading, especially during periods of market volatility or when faced with potential losses. It can lead investors to sell their stocks prematurely or avoid taking risks, which may result in missed opportunities for profit.

Greed is another emotion that can cloud judgment and lead to excessive risk-taking. It can cause investors to chase after high returns without considering the underlying risks or fundamentals of a company.

Overconfidence is a psychological bias where investors believe they have superior knowledge or skills compared to others. This can lead to overtrading, taking on excessive risks, and ignoring warning signs in the market.

To control emotions and stay disciplined in stock trading, investors need to develop a trading plan and stick to it. This involves setting clear goals, defining risk tolerance, and establishing rules for buying and selling stocks. It also requires regular self-reflection and evaluation to identify any emotional biases and make necessary adjustments.

Building a Trading Plan: Setting Goals and Executing Trades

Having a trading plan is essential in stock trading as it provides a roadmap for investors to follow and helps them stay focused on their goals. A trading plan outlines the investor’s objectives, risk tolerance, preferred trading strategies, and rules for entering and exiting trades.

Setting clear goals is an important part of building a trading plan. Investors need to define their financial objectives, such as the desired rate of return or the amount of capital they want to allocate to stock trading. They also need to consider their time horizon and liquidity needs to determine the appropriate investment strategy.

Executing trades based on the trading plan requires discipline and adherence to the predefined rules. This includes setting entry and exit points for trades, determining the position size based on risk tolerance, and implementing stop-loss orders to limit potential losses.

Regularly reviewing and updating the trading plan is also important to ensure that it remains aligned with the investor’s goals and market conditions. This may involve adjusting risk levels, revising trading strategies, or reallocating capital based on changing market dynamics.

Resources for Further Learning and Development in Stock Trading

There are numerous resources available for individuals looking to further their learning and development in stock trading. Online courses and tutorials provide structured education on various aspects of stock trading, from basic concepts to advanced strategies. These courses often include video lectures, quizzes, and interactive exercises to enhance learning.

Trading communities and forums are another valuable resource for traders. These platforms allow individuals to connect with like-minded individuals, share ideas, and learn from experienced traders. They provide a supportive environment where traders can ask questions, seek advice, and gain insights into different trading strategies.

Trading simulators and platforms are also useful tools for learning and practicing stock trading. These platforms allow individuals to trade virtual money in real-time market conditions, providing a risk-free environment to test different strategies and gain practical experience.

In conclusion, stock trading is a complex and dynamic field that requires continuous learning and development. Education is crucial in stock trading as it provides individuals with the knowledge and skills needed to make informed investment decisions. By understanding technical analysis, fundamental analysis, trading strategies, risk management, psychology, and building a trading plan, investors can increase their chances of success in the stock market. There are various resources available for further learning and development, including books, online courses, trading communities, and simulators. With the right education and resources, individuals can navigate the complexities of the stock market and potentially achieve their financial goals.

FAQs

What are books on how to trade stocks?

Books on how to trade stocks are educational resources that provide information and guidance on how to invest in the stock market. They cover topics such as stock market basics, technical analysis, fundamental analysis, risk management, and trading strategies.

Who can benefit from reading books on how to trade stocks?

Anyone who is interested in investing in the stock market can benefit from reading books on how to trade stocks. These books are particularly useful for beginners who are just starting out and want to learn the basics of stock trading.

What are some popular books on how to trade stocks?

Some popular books on how to trade stocks include “The Intelligent Investor” by Benjamin Graham, “How to Make Money in Stocks” by William J. O’Neil, “Technical Analysis of the Financial Markets” by John J. Murphy, and “Trading in the Zone” by Mark Douglas.

Are books on how to trade stocks a substitute for professional financial advice?

No, books on how to trade stocks are not a substitute for professional financial advice. While they can provide valuable information and guidance, it is important to consult with a financial advisor before making any investment decisions.

Where can I find books on how to trade stocks?

Books on how to trade stocks can be found at most bookstores, both online and offline. They can also be found at libraries and through online retailers such as Amazon.

Your article helped me a lot, is there any more related content? Thanks!